Safe Note Template

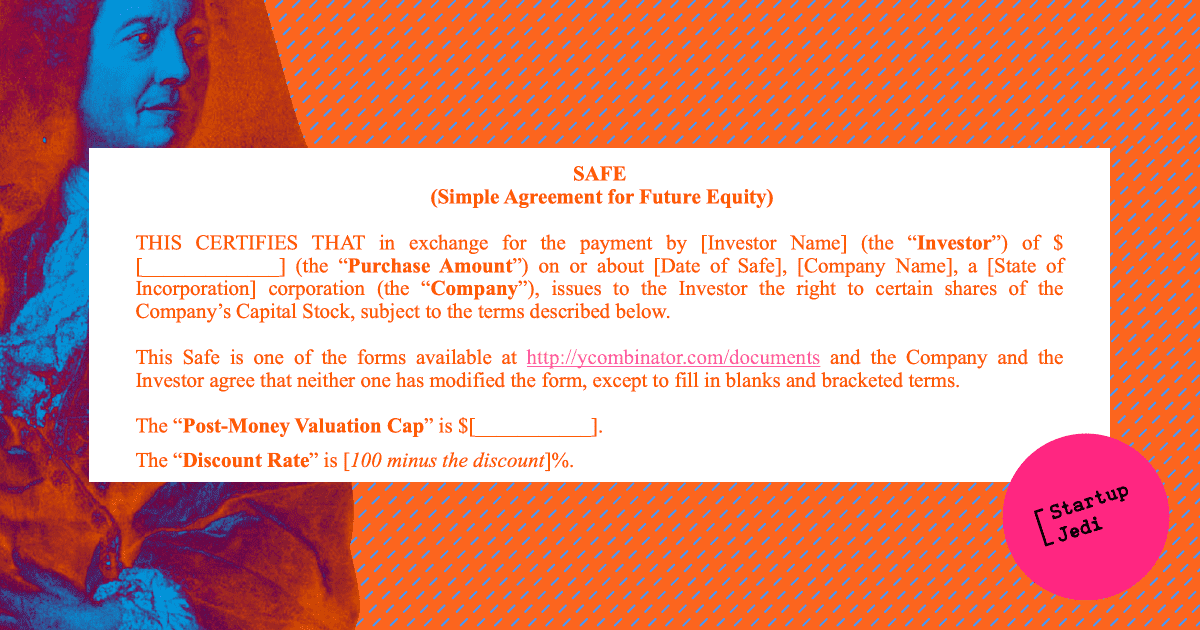

Safe Note Template - So, if the priced round is higher than the cap, then the safe converts at the cap, which means that the safe holders basically get more shares for the same amount of money than the. A group of people pool funds to fund a safe note with a 2x cash liquidation preference. The safe user guide explains how the safe converts, with sample calculations, an explanation of the pro rata side letter, and suggestions for best use. While the safe may not be suitable for all. If there are twenty different possible funding mechanisms and you have. A safe can have a valuation cap, or be. Series a term sheet template a standard and clean series a term sheet while working with companies in yc’s series a program we’ve noticed a common problem:

If there are twenty different possible funding mechanisms and you have. Original sales agreement and new cloud service agreement since 2015, yc has provided a free, downloadable template sales agreement to give any software. So, if the priced round is higher than the cap, then the safe converts at the cap, which means that the safe holders basically get more shares for the same amount of money than the. A safe can have a valuation cap, or be.

So the next time the company raises money, they set aside 2x (or 1.5x or what. If there are twenty different possible funding mechanisms and you have. A safe is like a convertible note in that the investor buys not stock itself but the right to buy stock in an equity round when it occurs. The safe user guide explains how the safe converts, with sample calculations, an explanation of the pro rata side letter, and suggestions for best use. So, if the priced round is higher than the cap, then the safe converts at the cap, which means that the safe holders basically get more shares for the same amount of money than the. The power of the safe note is that you don't need to worry about the terms, you know it's acceptable.

A safe is like a convertible note in that the investor buys not stock itself but the right to buy stock in an equity round when it occurs. The safe user guide explains how the safe converts, with sample calculations, an explanation of the pro rata side letter, and suggestions for best use. A group of people pool funds to fund a safe note with a 2x cash liquidation preference. So the next time the company raises money, they set aside 2x (or 1.5x or what. If there are twenty different possible funding mechanisms and you have.

So the next time the company raises money, they set aside 2x (or 1.5x or what. While the safe may not be suitable for all. Original sales agreement and new cloud service agreement since 2015, yc has provided a free, downloadable template sales agreement to give any software. So, if the priced round is higher than the cap, then the safe converts at the cap, which means that the safe holders basically get more shares for the same amount of money than the.

So, If The Priced Round Is Higher Than The Cap, Then The Safe Converts At The Cap, Which Means That The Safe Holders Basically Get More Shares For The Same Amount Of Money Than The.

Series a term sheet template a standard and clean series a term sheet while working with companies in yc’s series a program we’ve noticed a common problem: A safe is like a convertible note in that the investor buys not stock itself but the right to buy stock in an equity round when it occurs. So the next time the company raises money, they set aside 2x (or 1.5x or what. A group of people pool funds to fund a safe note with a 2x cash liquidation preference.

If There Are Twenty Different Possible Funding Mechanisms And You Have.

Original sales agreement and new cloud service agreement since 2015, yc has provided a free, downloadable template sales agreement to give any software. A safe can have a valuation cap, or be. The safe user guide explains how the safe converts, with sample calculations, an explanation of the pro rata side letter, and suggestions for best use. While the safe may not be suitable for all.

The Power Of The Safe Note Is That You Don't Need To Worry About The Terms, You Know It's Acceptable.

While the safe may not be suitable for all. A group of people pool funds to fund a safe note with a 2x cash liquidation preference. A safe is like a convertible note in that the investor buys not stock itself but the right to buy stock in an equity round when it occurs. So the next time the company raises money, they set aside 2x (or 1.5x or what. Series a term sheet template a standard and clean series a term sheet while working with companies in yc’s series a program we’ve noticed a common problem: